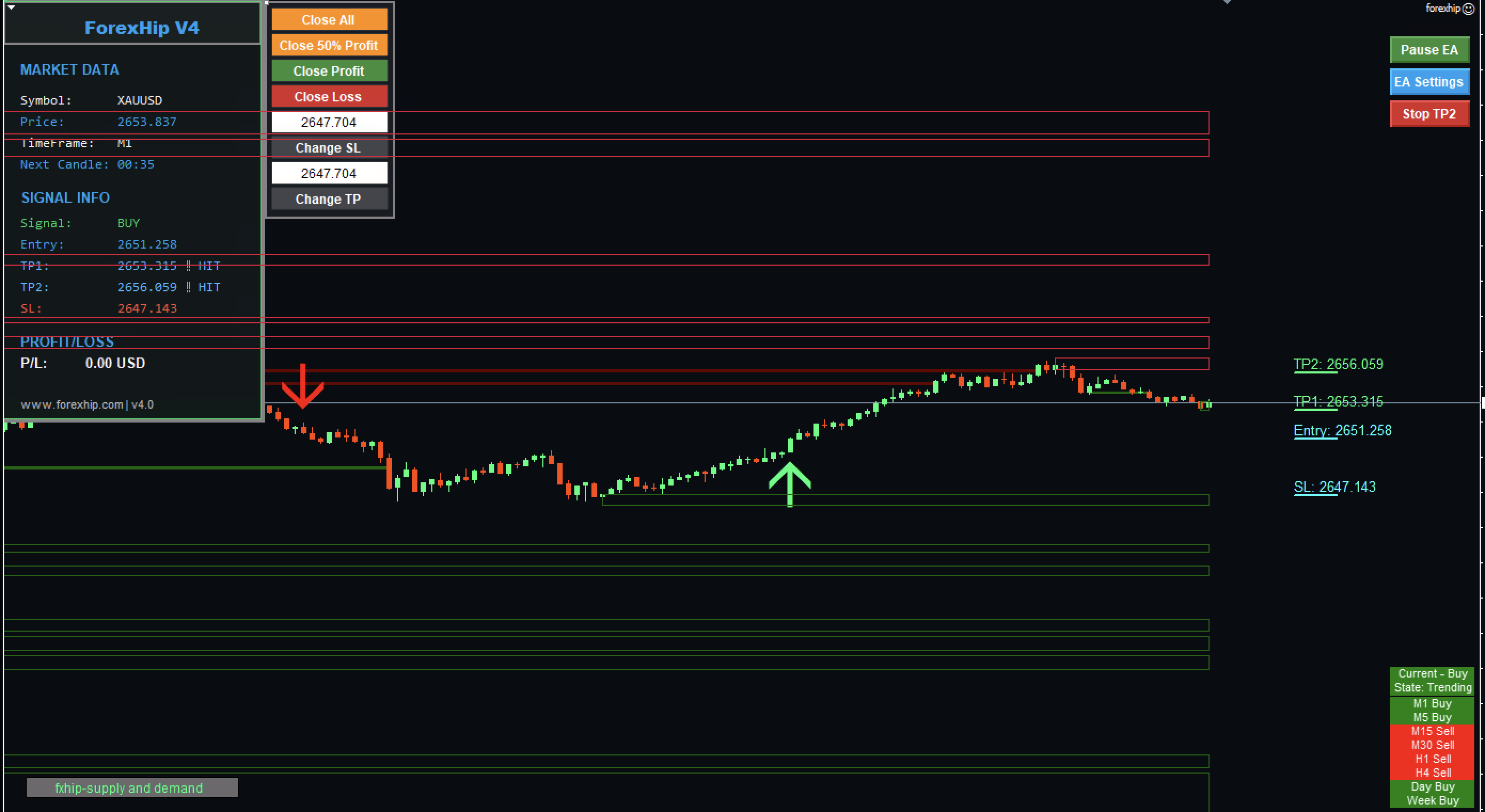

Forexhip V4

Professional Forex Trading EA with Advanced Multi-TP System

One-time Payment - Lifetime Access - Free Updates

Watch Installation Guide

Professional Trading Features

Dual Take-Profit System

Trade with two take profit levels (TP1 & TP2) with different lot sizes for optimal risk management.

Advanced Risk Management

Set daily profit targets and stop loss limits with automatic trade closure for account protection.

Real-time Monitoring

Track your trades, profit/loss, and account status in real-time with our professional interface.

Smart Notifications

Stay informed with customizable alerts for TP hits, SL hits, and trade modifications.

Professional Trading Panel

Manage your trades easily with our comprehensive trading panel featuring one-click trade management.

Martingale Options

Optional martingale strategy with safety limits and maximum lot size protection.

Flexible Controls

Pause/Resume trading, disable TP2, and modify trade parameters with easy-to-use controls.

Complete Feature List

Trading Features

- Dual Take-Profit System (TP1 & TP2)

- Different Lot Sizes for Each TP

- Automatic Breakeven After TP1

- One-Click TP2 Disable Option

- Optional Martingale Strategy

- Customizable Martingale Multiplier

- Maximum Martingale Levels Control

Risk Management

- Daily Profit Target

- Daily Stop Loss Limit

- Auto Close on Limits

- Maximum Lot Size Protection

- Real-time P/L Tracking

Professional Tools

- Comprehensive Trading Panel

- Close All Trades Button

- Close Profitable Trades Only

- Close Loss Trades Only

- Close 50% of Profits Option

- Easy SL/TP Modification

- Pause/Resume Trading

Additional Features

- Sound Alerts for TP/SL Hits

- On-chart Notifications

- Trade Status Updates

- Daily P/L Updates

- Draggable Interface Windows

- Professional License System

- 24/7 Support Access

Why Choose Forexhip V4?

Forexhip V4 is a complete trading solution with professional features and lifetime support.

Additional Screenshots:

Quick and Easy Installation

Watch our step-by-step guide to get Forexhip Scalper v3 up and running in minutes:

What Our Users Say

Forexhip Scalper v3 has completely transformed my trading strategy! I'm seeing consistent profits for the first time.

Jane Doe

Forex Trader

I achieved consistent profits thanks to the high accuracy signals. This indicator is a game-changer.

John Smith

Professional Trader

Even with a busy schedule, I'm able to trade successfully with Forexhip. The user interface is very intuitive and easy to use.

Emily Johnson

Part-Time Trader

I've tried various indicators, but Forexhip is by far the best! The support team is also very responsive and helpful.

Michael Brown

Investor

Frequently Asked Questions

Is this a one-time payment?

Yes, Forexhip V4 is available for a one-time payment of $89. This includes lifetime access to the EA and all future updates.

Does this support MT5?

At this time, Forexhip V4 only supports MT4. You can open an account with any broker that offers MT4 to use our EA.

What is Forexhip V4?

It's a professional Forex trading EA with advanced features including dual take-profit system, risk management, and real-time monitoring. Perfect for both beginners and experienced traders.

Do I need prior trading experience?

No, Forexhip V4 is user-friendly and suitable for all experience levels. Our comprehensive interface and clear documentation make it easy to start trading.

Ready to Revolutionize Your Trading?

Join thousands of successful traders using Forexhip Scalper v3

Get in Touch

Have questions or need support? Our team is here to help you 24/7.

Contact Forexhip Admin